Bitcoin Terminal value

A Bitcoin podcast with short episodes (executive summaries) covering my thesis on the future of Bitcoin adoption, competitive landscape, use cases, and network value.

I listen to most of the popular bitcoin podcasts and they are 1-2 hours of lost time for most people with any level of bitcoin knowledge.

Bitcoin terminal value podcasts are short episodes which revolve around an important topic - packed with information that is being missed (or rarely covered).

- Michael Miller IV

Bitcoin Terminal value

Ep #2 Bitcoin Valuation discussion

Use Left/Right to seek, Home/End to jump to start or end. Hold shift to jump forward or backward.

Global Money creation doubles ever ~6 years (US doubles every ~8 years). This website has a really informative table that shows the change in Global money over time. https://porkopolis.io/basemoney.

Global money creation will lead to Bitcoin adoption. As Bitcoin moves up the adoption of innovation curve then the network value will increase at a rate of money creation (14% CAGR) + some premium for adoption + some premium for increasing scarcity (halvings).

Global money creation is a constant over thousands of years. You can count on death, taxes, and exponential money creation by governments, banks, and central banks. MONEY CREATION IS THE ROCKET FUEL FOR BITCOIN ADOPTION AND VALUATION.

In this episode I discuss a couple of the methods we can use to make a directional estimate of Bitcoin´s future network value:

- Supply (stock to flow)

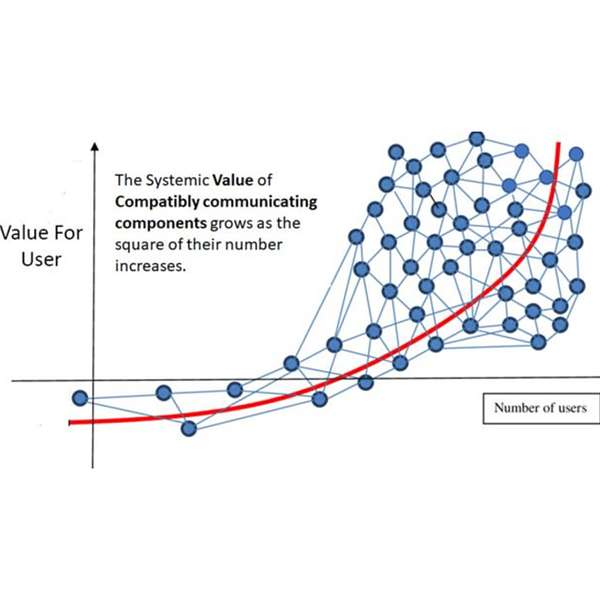

- Demand (Metcalfe´s law)

Peace, Love and Abundance

-Michael

Okay, welcome back to Bitcoin Terminal Value. Uh, today, I , the show's topic is , uh, Bitcoin valuation. And so we have a , a number of , um, valuation methodologies, and I'm sure you've read these. There , there's a lot of different , um, well-respected analysts out there, including Fidelity , uh, arc , um, and Plan B. Many others that have talked about the stock to flow , they , they've talked about some of the valuations models I'm gonna talk about today. So stock to flow , flow is one of 'em. Uh , and you can read all these , uh, uh, at those , uh, like on the, fidelity has a good report , uh, that they put on on these. Metcalf's Law is another one. Um, and then also I wanna talk a little bit about the realized price. So the multiple of , uh, of what , uh, the value that goes into Bitcoin, and then what market cap that should drive. Um, and then also one of the mistakes that people make, people always make valuation calculations using today's dollars. Uh , I really like ESUs . He has a , um, uh, his , his real name . He came, he used to be anonymous, but , uh, today his , um, name is Jesse Meyers . He has good article, really good articles on Bitcoin, and some of his valuation methodologies are great, but they always talk about 900 trillion , uh, which is kind of the amount of , uh, wealth in the world today. Uh, but that, just looking, taking a look at today's, the wealth in the world today is, is to me that isn't , uh, that's a mistake that people made when , uh, talking about the valuation, and I'll talk a little bit more about that later. So , uh, stock to flow model , um, it , it's been that that model has been attacked recently. It came out in 2019 at the low of the bear market when Bitcoin was at 4,000. And , and what it basically says is stock to flow is, it's kind of like a supply side. So it's just basically saying like the new quantity being created. Uh, so like gold, the new quantity of gold being created is like two or 3% a year. It has a stock to flow ratio of 50. Um, and then , uh, real estate is, has a stock to flow, I've seen of about a hundred. And so , um, yeah, what that means is that the quantity of real estate that turns over every year is a small fraction of the total amount of the housing stock. Uh, and so the more , uh, let's say rare something is the higher the stock to flow ratio. So like real estate has a higher stock to flow ratio than gold, which is historically the quantity. People think it goes up over the long term , like three to 4% a year. Uh, and it has a much higher stock to flow ratio than , uh, silver. Uh, and I'm not sure the quantity increases of silver, but just based on the stock to flow, I know and it's valuation, I know that it would go up in quantity more than gold. Um, and so , uh, plan B has a really good articles, you can check that out on the soc to flow ratio. It , it predicts a , a 10 x , um, in the value of Bitcoin for each , uh, having event. And the having occurs every four years in Bitcoin , uh, where the amount of Bitcoin available for miners , uh, gets cut in half every four years. And , um, just to give an idea of where it is today , um, Bitcoin has a stock to flow similar , similar to gold today. Um, and so there was a lot of discussion in regards to the stock to flow , and he act Plan B actually released two stock to flows one. Um, the first one had a little bit , uh, more conservative of a price target during this having and subsequent havings, 'cause they're all based on each other. Then he, he re later released one that's called the Stock to flow fx. Um, and I'm not gonna get into all the details of those, but basically , um, the stock to flow , I, I think that , um, it's a supply side model and I think it's useful, it's useful as a directional tool. That's how I would say it. And so , um, and , and there's two kind of things that I don't think that, I mean, of course, a model that's predict , you can't predict prices with a model. It's just not how it works. Um, people buying and selling assets don't, they're not gonna conform to something that could be predicted into the future like that with a model. But I do think it's directionally a useful tool. And I think directionally it's correct over time, I think that the price of Bitcoin will trend toward what the stock to floors says it should over time, assuming adoption. And I mean everything kind of, it is assuming adoption and I , I , I believe that adoption will happen and it has been happening. Um, but the mistake that for me, that the stock to flow makes, the first one is that the other assets in the model that it's comparing to have already gone through the entire adoption of innovation curve. Uh , so like gold was adopted thousands of years ago. Silver was adopted thousands of years ago. Real estate was adopted thousands of years ago. If you look at the adoption of innovation curve , uh, it's already gone through the innovators. Uh, it's crossed the chasm, the early majority, the late majority. So, so , uh, Bitcoin is not there and it's still at a very early stage. And also to increase complexity. When we think of quote unquote adoption, it's really hard to, to tally up adoption because you'll see even in the Fidelity report, oh, they count Bitcoin addresses. But that's not a good measure of adoption because you have to try to aggregate all the exchanges too, because people, if they have their , uh, Bitcoin on exchanges , uh, it's more dangerous. But it's also, exchanges can, let's say that Coinbase has, I don't know, a hundred million users , um, but they're not gonna have the , they're not gonna have a Bitcoin address open for each individual user. They may , they will hold all a hundred million users Bitcoin in a fraction of , in a small subset of addresses. So anyway , um, the stock to flow , that's the first mistake that people make when thinking about the stock to flow. It hasn't gone through the full adoption. It's not a mature asset, but I still think it's useful directionally , uh, what it, what the stock to flow tells me is that based on Bitcoin's quantity today, if it had already gone through the stock to flow , uh, or the, the adoption of innovation curve completely , um, and it was a mature asset that's been around for 50 years, I think it would have a much higher , um, market cap than that of, than that of gold today, which is , uh, $12 trillion. Um, and , and then of course it's gonna demonetize a lot of other assets and , and commodities. And so I think it would have a much, much higher , um, uh, market cap than gold, which has the same stock to flow as Bitcoin today. Um , but so that's the first mistake. The second mistake of the model, in my mind is that it doesn't take into account the macro environment. So like , uh, Bitcoin was created in 2009, but since 2009, there hasn't been a huge macro event until, well, until C O V I D in March of 2020. And then also , um, there's a massive bond market meltdown , uh, in 2022. There's a stock market meltdown kind of simultaneously. Um, in 2022, the Luna, F F T X, Celsius, block Fi , all the , is just the carnage of the crypto space. Um, and , and there was a lot of FUD that was coming out of the government because the Fed chair people like Elizabeth Warren, there's a lot of fear, uncertainty , or doubt thrown at Bitcoin just because it had never been taken seriously before, let's say 2021 , with a huge increase in adoption and price. So I , I think that the stock to flow, I mean, it's not a model that can really, of course, it can never predict massive, like a massive bond and stock market meltdown. And then once, once the price of Bitcoin reacts to something like that, because there's carnage in , in a lot of different assets, that's psychologically I impacts where the price of Bitcoin will go in the short run. Um, and Warren Buffett has a quote about the short run being kind of , um, a popularity contest. Th this is related to stocks, but it, I think it's similar to every asset. It's a popularity contest in the short run, in the long run, it'll trend toward , um, it's a weighing machine. And so it kind of trends toward what it should be. Um, Okay, on the flip side of that , um, so stock to flow , I think of is kind of the supply side. Uh, I think of Metcalf's Law as the demand side. And Metcalf's law is a really big thing in, in the tech world, in the Silicon Valley world. Um, and , and it talks about network effects. And so , um, as the number of users increases, the value of a network , um, is the square of the users. So, so like as Bitcoin, let's say hypothetically Bitcoin went from 10 million users to 20 million users, the value of the network in it wouldn't go up from 10 to 20. Um, it would go up, the, the, the network doubled. And so the, the value of the full network would be the square of two, which would be four. Um, so, so it , it , it's basically predicts exponential growth for technology companies. And , and you , you see this , um, in a lot of different companies like, like Google , um, uh, Facebook, Instagram, WhatsApp. Um , if you check the , you know, what Metcalf's loss says that Instagram should be worth as it goes from 100 million users to 1 billion users. So then it says, okay, you go from a hundred million users to a billion users, that's a 10 x in the number of users. And as we said, it's a , it's a square root of the number of users. So 10 x squared is gonna be a hundred. So it says, okay, the value of the network went up a hundred x. And, and if you look at the value of Instagram as it's gone from a hundred million users to a billion users, the value of the network a hundred xd. And, and so , uh, like the soc to flow , I mean, it's not gonna be perfect. And, you know, if you have , um, if you have these, if , if we're talking about network effects, you're obviously talking about something that has a lot of value. Um, you know, like the biggest company in the world have network effects, whether that's Amazon or Visa, MasterCard , uh, Google. Um, and so there aren't, there aren't that many buyers. I mean, of course the stock market is a , you know, it shows the, the value of the , um, of the company or what investors think the company of worth is worth, but it , it's kind of manic, but it , I I guess it's, it's not, you know, just like soc Delo , it's kind of a directional estimation. Um, but the thing for me that I , that a point that I want to get across is that , um, finding a young network, I mean, that's what every , uh, venture capitalist wants to do is like, like Uber, Uber's a network. Uh , it's <laugh> , it's still not profitable, but it's a network. Um, they want find , um, a young network with, with really good network effects, because then you have exponential growth and , and exponential growth is, is what you want . There's also , um, I listened to a podcast with Bill Miller where he talked about Brian Arthur, and , uh, Brian Arthur was the one that , um, brought up that, that network effects trend toward , um, a , a winner take all . And you can see this like in social media or even with Google, with search engines , um, and , and , and those markets, Brian Arthurs states that those markets, the , the first, it's kind of like the first person that can capture the network effects in a certain market. Uh, they have increasing returns. Uh, so, so just to summarize everything , uh, you know, Metcalf's Law talks about network effects and network effects create , um, uh, create winner take all markets that have increasing returns. And , uh, there's exponential growth. So as the number of users go up, the, the value of the network is the square of the, of the delta and the number of users. So, Okay, so just to summarize the supply side, the stock to flow , um, it applies, implies exponential growth , uh, just because , uh, we're used to a world in which there's nothing is scarce , uh, or not many things are scarce. Let's say currencies are the opposite of scarce. They're abundant and they cagr at the quantity of currencies, CERs at, at 14% a year. So that's the opposite of scarce. If you just stocked a flow of currencies, they would be, it would be super low. And it really had , it creates incentives for people to find , try to find things that are scarce like real estate. Why , why does real estate always go up in value ? Well, it's because of the continually continual, the basement of currency. Um, and, and so on the supply side , uh, you have something that's, has the same stock to float today as gold, but in April of 2024, after the having , uh, bitcoin for the next four years after that will go up 0.8% a year. Uh, and so the stock to flow will be two x that of gold. Um, and it will be more or less in line with real estate, one of the scars assets that there is out there. And then in four years and , um, nine months, four years, and nine months from now, Bitcoin is gonna have two x the , the stock to flow of real estate. So it's gonna be the scarcest asset in the world that everybody can buy in any country of the world. And around that time, it will have, it will be even further along into the adoption of innovation curve. Uh, and , and I'm gonna talk about the adoption of innovation curve in another podcast, but it's gonna be a further along in that. So , um, anyway, the supply side , uh, implies explosive, exponential growth , uh, and the stock to flow in the Fidelity report, once you get out into the late 2030s, it was implying a Bitcoin price of , uh, like a , a billion dollars a coin. Um, and so yeah, exponential growth on the demand side. So that's where Metcalf law comes into effect. And , and there's , fidelity has some good reports where they're looking at the demand side , um, you know, comparing Bitcoin and the adoption growth for the , versus the internet versus cell phones . Um, but the demand side of Metcalf's Law , uh, it, it , uh, implies that there's gonna be a winner take all with increasing returns. Uh, and , and, and that's what we've seen so far . And I think that's, I think that's gonna continue. I mean , I have another podcast where I talk about Bitcoin and, and quote unquote , potential competition and , and kind of walk through the , the logic there. But , um, anyway , uh, for now , uh, just talked about the supply side, demand side with Metcalf's Law winner take all on increasing returns. Then on top of the, so the supply side with stock to flow, implying exponential growth, the demand side with Metcalf's Law implying exponential growth. And then on top of that, you , you , the currency currencies worldwide. And like I said in the first podcast, you can't just, we always think in dollar terms because, oh , it's the dollar, but it's only, you know, 22% of the world's currencies , um, currencies worldwide. Uh, the yen is being printed like crazy. They , they double in quantity every six years. So currencies worldwide have exponential growth. So the supply side of Bitcoin implies exponential growth. The demand side of Bitcoin with Metcalf's law and network effects implies exponential growth. And then on top of that, the growth in the quantity of currencies , uh, is continually exponential throughout the last few thousand years of human history. And you might wonder, and I'll , I'll just touch on this quickly, okay? Uh , why do currencies, I mean, if they have exponential growth, if they're c at 14% compound annual growth per year at 14% in , in , in quantity, then how do they retain value? And it's like, well , uh, because they're all , uh, compounding it around 14% in supply a year. And , uh, I, I guess there's differences, but those differences are manifested in changes in effects over time. So take a look at a chart of the United States currency versus currencies in South America. And so you can understand kind of the long term I've seen, and I believe in this, I think that the change in currencies versus each other is mainly based on supply. 'cause the demand doesn't change so much. The growth rates of countries usually isn't so divergent. But, but anyway, just why , why does the , the euro and the dollar and the end not change that much is because they're all being based like crazy. So, I mean, it's kind of like if I was in quicksand and you're in quicksand, like 10 me 10 feet away from me and someone else is in quicksand , uh, it is kind of like all of the world's currencies are like quicksand. They're all being debased . And so if you're just looking at the person beside you, they're being sucked down in quicksand too. They might be a little bit faster or slower than you are, but you're both moving downwards. So, and , and it's also why scarce assets like real estate, like why are they always shooting up? It's like, well, because currencies are always being debated . It's a very easy answer. Uh, and it's always hard for me to believe that libertarians are some of the first people that are always talking about Bitcoin and about , um, you know, currency debasement. But they seem to, there's a , a lot of them that don't buy real estate, which is kind of shocking to me if you understand how much currency is being debased . I just don't understand how you can't think like, oh, I can borrow some , I can borrow 80% of the value of this, you know , $400,000 asset. I can borrow it 3% a year. Well, today it's higher, but , um, and then, you know, currency debasement is guaranteed. So I mean, it, it, it makes sense. But anyway, okay. Uh, the last thing I wanna wrap up with is that people think they're too late to Bitcoin because of the $560 billion market cap. And even the smartest people I know all think this way too. And everybody that come is new to Bitcoin , uh, including me. Uh, they always think that they're too late. I thought I was too late in 2017. Um, the , some of the smartest people I know think that they're too late today. Uh, but really, I mean, if you look at it from a data-driven perspective, it's still super early in the adoption of innovation curve. And, you know , there's all kinds of ranges and estimates. They're always going up, but nobody knows for sure how many people in Bitcoin, it's hard to aggregate all the number of users on exchanges. And even if we have, let's say there's, I don't know, 200 to 400 million people that have Bitcoin, how many of those have more than say, you know, it depends how much, how much of their investible assets do they have invested in it, and also how much the high net worth or governments , um, have invested in Bitcoin. If you look at that, it's like, well, if , uh, I mean, there's, there's a lot of different estimates. I heard , uh, an estimate from esis , the Jesse Meyers , that there's 2.2 billion people that have a , a certain amount of investible assets. I can't remember how much it was, but I think, I'll have to look it up again. And, and there's just a small fraction of that number of people that have a decent amount of investible assets that have invested in Bitcoin. Um, we're , we're still at the very small tip of the iceberg in terms of , um, institutional adoption. Um, and , and that can run the gamut of, you know, there's all kinds of institutional adoption that's on the way. I mean, insurance companies, there's a , a tiny, tiny fraction of, in insurance investible assets in Bitcoin , uh, hedge funds, mutual funds can't even really invest in Bitcoin unless they buy MicroStrategy. Um, and then family offices, there's all types, anyway, there's all types of institutions and and you've seen BlackRock. They're applying to have an e T F , they're selling Bitcoin to their private clients. All of Wall Street's in some way or another, starting to offer Bitcoin. Uh, I have , uh, bitcoin on fidelity. Uh, but anyway, my point being here that we're still still really, really early in the adoption of innovation curve. So if you think about it that way, it's like, well , um, you know, if you think about like the network value of something versus where it is in the adoption of innovation curve, if we're still super early and we haven't made , we've crossed the chasm with millennials and people under 15 , maybe , um, crossing the chasm means you've hit 15% adoption. Let's, let's say that that's a , we're we're somewhere around there a little bit past there, I think for people under 50. Well, that, I mean, that just means we've had a fraction of the investible assets of the world and a fraction of the people in the world that have adopted. Uh , so we're still super early. Um, So we're still super early. So I mean, if you look at the, the, how much user growth has grown from 10 years ago to today, and then you look at the adoption of innovation curve and say that, okay, we just crossed the chasm. So now if we're gonna cross the chasm, and then like 10 years from now, I don't know, we will be somewhere in the late, it will be later on in the early majority or maybe in the, in the , um, uh, the, the second at the , the group after the early majority would be, which would be the, the late majority, we're gonna be somewhere in there. But if you look at the delta, and I've looked at that before, I, I think the, the number of users, let's say it has gone up, I don't know, 20 x in the past 10 years, let's say it's gone up 20 x in the past 10 years. I , I , I'll have to double check the numbers on that. Um, you know, it might go up 10 x in the next 10 years, which is , you know, still a huge number. I mean, if you use 10 x with Metcalf's law, then the value of the network should a hundred x and that's in today's dollars. It doesn't even include the, the currency to basement and also maybe stock to flow impacts. Um, but anyway, so I I , the , the , the growth in the number of users from the last 10 years to the next 10 years , um, it , it , it , it might be less in the next 10 years, but it's not gonna be drastically less. So the component of the, the, the valuation of Bitcoin, let's say the last 10 years versus the next 10 years, it's gonna be user growth, the stock to flow change, and Metcalf's law change, stock to flow being the supply change, Metcalf's law being the demand change. And I guess the user growth is yeah , kind of rolled in with the, with the Metcalf's law or the demand change. But yeah, the , and like I just talked about, the , the user growth, the last 10 years, much higher than it will be the next 10 years, but the next 10 years are still gonna be really high. And then if you look at the stock to flow change over the next 10 years , um, it's gonna have the exact same impact over the last 10 years because e every four years there's a having. Um, so , uh, the , the supply impact should be, should be the same . I mean, it's gonna get much, much more , uh, scarce over time. And just to put some, just to put some numbers to it, so, so like all the world , the wealth in the world today is $900 trillion. That includes , um, currency bonds , um, real estate , uh, commodities, whatever assets you can think of. Um, and the amount of money that's been put into Bitcoin is somewhere around 300 , um, billion dollars , uh, out of $900 trillion in worldwide wealth, which makes sense, like I just talked about, is still, we're still early. Um, and then, so out of that $300 billion in, in money that's been put into Bitcoin, the market cap is 600 billion. So let's say , uh, 10 years from now, or say 12 years from now. So if, if the amount of money in circulation doubles every six years, then 12 years from now , uh, then six years from now it's gonna double, and then 12 years from now, it's gonna four x. So let's say 12 years from now, that 900 trillion's gonna be 3,600 trillion. Um, and then let's say that, I don't know, 5% of the world's wealth has gone into Bitcoin by then, which seems like a pretty low amount if it goes through the adoption of innovation curve. Um, and, but if it does , let's say 5%, so 5% would be $180 trillion, and then you can put a multiple on the , that would be the realized cap, and then , um, the market cap would be some multiple on top of that. Currently it's, it's a two x, but I , I think as it becomes more and more scarce over time, and people start to realize , um, I mean, people start to become more familiar with the stock to flow with Metcalf's law and , and, and understand that it's, it's a winner take all with increasing returns, then I , I think that the, the multiplier, if the multiplier's two x, then it's gonna be a $360 trillion asset. And so it will have gone up , uh, 700 x and if the multiplier was four x the 180 trillion, then it would be somewhere around 720 trillion. And then, so that would've gone up, you know, 1300 and X. So it's pretty, pretty , um, crazy math when you, when you, you know, plug those numbers in. But I think it's a really telling, if you look back at Hal Finney , uh, has, has , uh, an , an email, I actually think Hal Finney is sat Toshi nakamoto, by the way. But if you look at b back at Hal Finney e in Hal Finney's email , uh, in, I think it was 2010, if he, and he was saying like, oh, I've seen estimates of worldwide wealth in between , um, 100 and $300 trillion. And so it's so funny to see that , like, okay, that was in 2010. Um, and then so he , he's seeing worldwide wealth between 100 and 300 trillion in 2010. Uh, and then today I'm saying that like, the estimate that I'm seeing is like $900 trillion, and you're like, wow, that's a, you know, that's like a three x. And it's like, yeah, that , that's a three x because, you know, it's been, it's been a full , um, 13 years since then. And , and so money has, the amount of money in circulation has more or less four Xed . So , um, so yeah. Uh, and , and like I said in the first podcast, money creation is like rocket fuel for Bitcoin , uh, valuation and money creation is like rocket fuel for Bitcoin adoption. Uh, and , and on top of that, if Bitcoin is adopted because it's gonna be adopted, because it's scarce, primarily because it's scarce, it's not like the technology is that amazing. It it's not, I mean, some people miss , miss out on that, and they're like, oh, what about Venmo or Cash app, or whatever. It's like, it's not about the technology, it's about the scarcity of having property rights for something scarce, which for, you know, however long people in governments and banks have existed , uh, even under the gold standard. And , and I, I can do a whole nother podcast on that, and I talked about it some in my last podcast, even under a gold standard, money wasn't scarce. Um, and , and , uh, so this is the first time that there's property rights that everybody in the world can buy at any moment. It , it trades 365 days a year , um, property rights of something scarce, and that's gonna become even scarcer. It's not most commodities like gold or copper or silver. Um, as the price goes up, well then , uh, the supply is gonna react to that because people wanna , uh, will want to, you know, to pull up more , uh, to, to then sell into the market. But Bitcoin kind of reacts the opposite , um, as , uh, as adoption continues and as time passes on, it becomes a more and more scarce, which drives, and that scarcity drives adoption. And that adoption creates network effects. And those network effects create a winner take all , and that, and that network effects, that create winner take all creates increasing returns , um, according to Brian Arthur's , uh, theory. So, and then when you do the math, like, like I just did the math and , uh, Hal Finney did the math in 2010. He said, oh, there's a hundred to , you know, three or 400 million trillion dollars of wealth in the world. I'm doing the math with $900 trillion in 2023. And why is that? Well, there's just been a shitload of money printing. So, so , uh, and , and we can be assured that, you know, from now until the next 10 or 12 years, there's gonna be a huge amount of money printing. Uh, so, so I mean, I , if, if adoption continues, bitcoin's gonna be a winner take all , um, the supply side says that there's going to be exponential growth in the network. Uh , the demand side with Metcalf's Law says there's gonna be exponential growth in the network, and then , uh, the quantity of currency growth worldwide by irresponsible government, central banks and banks , uh, is going to be exponential, which is gonna be rocket fuel for the , the network value. So, so that's kind of, that's kind of my thesis and , um, I really appreciate you joining me for the , uh, for the second podcast. And , uh, I hope to hear and talk to everyone soon. Thank you . <silence> .